Table of Contents

- New Mexico Small Business Saturday Tax Holiday 2024: What to Know ...

- Delivering tax relief for New Mexico families and businesses

- New Mexico Tax Essentials for Small Enterprises: A Detailed Guide

- Sales Tax In New Mexico 2024 - Starr Emmaline

- New Mexico State Taxes Guide

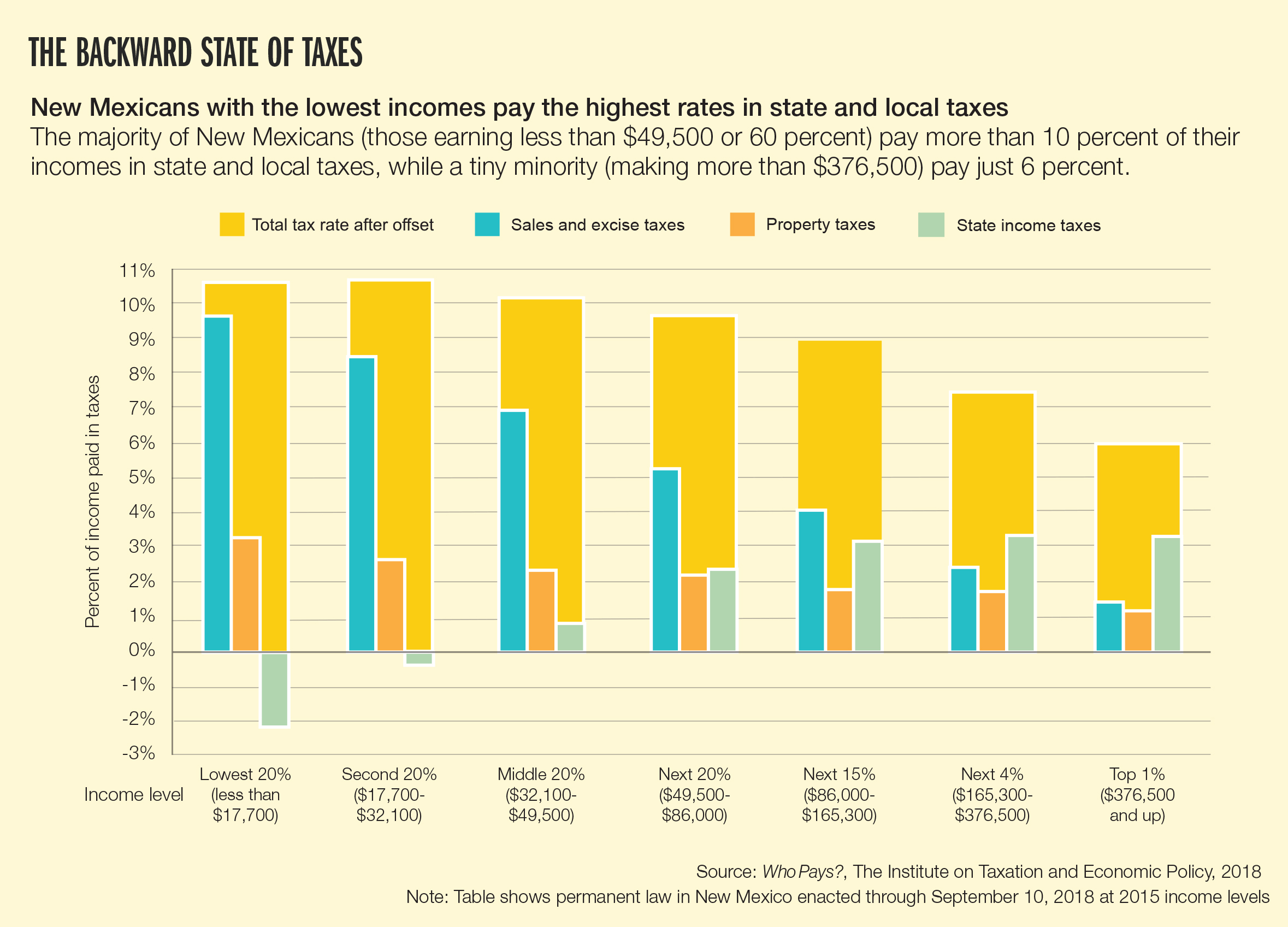

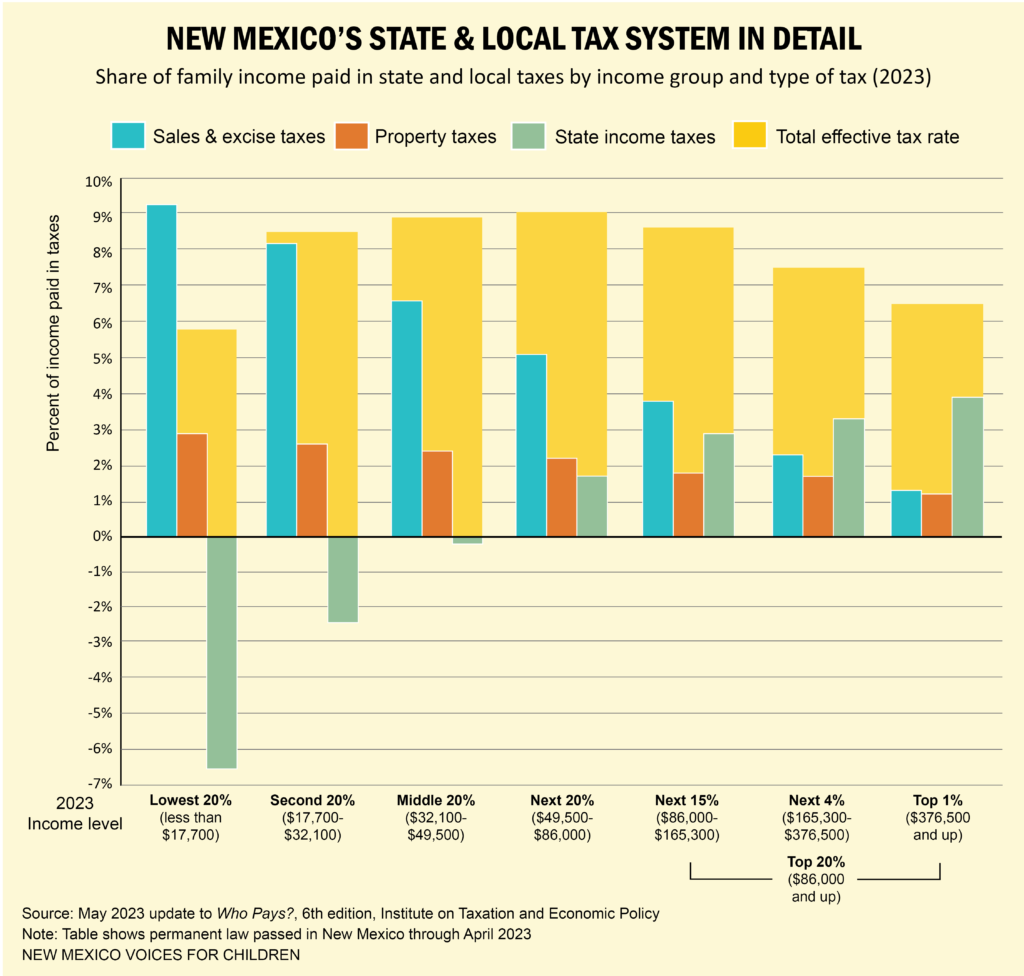

- A Guide to New Mexico’s Tax System – New Mexico Voices for Children

- Sales Tax In New Mexico 2024 - Starr Emmaline

- New Mexico Tax Calculator 2025 - Hinda Leelah

- Back-to-school tax-free weekend in New Mexico 2023

- 0M heading to New Mexico taxpayers, starting this week; Taxpayers ...

.png)

What are Sales Tax Holidays?

2025 Sales Tax Holidays by State